Gene Bellinger – our systems thinking guru – has been inventing a model of economy, in order to understand economy. I added a comment on the discussion there, because i Read: “Gene, If you want to understand economics I suggest you avoid the advice you get from linguists.” There is an – in my view – interesting double bind at work. Here is the comment:

Gene Bellinger – our systems thinking guru – has been inventing a model of economy, in order to understand economy. I added a comment on the discussion there, because i Read: “Gene, If you want to understand economics I suggest you avoid the advice you get from linguists.” There is an – in my view – interesting double bind at work. Here is the comment:

In Physics I’ve learned to recognize the difference between an “observable” and a “system variable“. (If you don’t manage it, you’ll never pass your exams) The first can be counted, irrespective of any observer, the second can only be calculated through a system of rules. For instance, my house, your house can be observed. You can count the number of rooms, inhabitants, … . These observables always have a limit, are constrained.

The age of the house, has to be calculated. It depends on the assumption of a starting point (laying of the foundation? roof? key to the first inhabitant?). So “time” is a systems variable and not an observable. Also the value of an house is a system variable: it depends on the system “in use”. It is not an attribute of the house, but an attribute of a relationship with the house. In The Netherlands, we used to say that the value of an house is “whatever a fool will pay”.

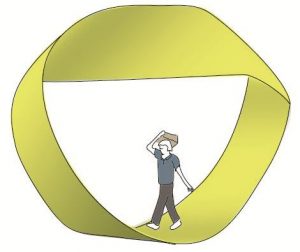

A system variable comes in handy to describe, to model the behavior of observables. Using it, you can more or less predict the outcome of an experiment, which is always an observable, and thus verify the model. However, a model is not reality. And the system variable only exist in our minds. They are not real, nor unreal: they are surreal, a product of our imagination. System variables are not facts, they are fiction. (However, both words are derived from “facere”, to make). Because they are fiction, they might have no limit, are not constrained to physical laws.

“Money” is a systems variable. We use it to calculate – usually called “costs”. Money is also an observable, when we’re talking about coins. They can be counted and measured – for instance in pounds or shekel. Now our imagination made an invention: why not relate the worth of something to the value of a coin. The number of houses is limited, the worth to its inhabitants also – you cannot live in two houses at the same time – but the value is not. (The value depends on three laws of real (!) estate: location, location, location. Location is real, value is imaginary) You can own a great number – but limited – houses. But their monetary value can rise without limit. Most people think they’re a fool, because they didn’t buy houses years ago.

The problem we have in understanding economy, is because the model is “flawed”. (I could have tackled this directly from scarcity, that’s how economist do it, but you can figure it out yourself). One of the most interesting system variables – in my opinion mind you -, is “meaning”. Goods and services have a “meaning”. And not only the goods and services themselves, also the money used in the description has a meaning. Money means status, power. You don’t only buy an house, you also give expression to your authority, creativity and courage. It gives you a feeling of independence. Money represents “free” power, because you’re free to spend it. Furthermore, all money is a currency and expresses a nationality, a belonging. (This is one of the hidden issues with the Euro).

The reason I used the very word “house” in this post, is because economy started out as “managing your house”, in Dutch, “Huishoudkunde”, the art of maintaining your house. Off course, “house” also indicates government – which is why we in The Netherlands speak about “geld”: which is something like “legal”. (Money, I read, is derived from “monitor”, to overlook. It has been connected to the Temple of Juno, who is, you’ve guessed, the goddess of the household. Maintaining the household). And, last but not least, “house” belongs to the archetype of “self”. And here is the fundamental flaw: you’re part of the model you’re using in describing your behavior.